Revenue: Growth of 5.4% (YoY), 4.4% (YoY CC) & 2.2% (QoQ).

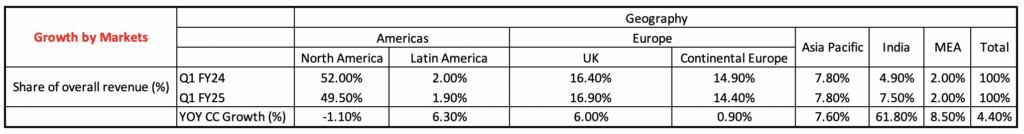

- Growth Breakdown by Markets

Core Markets:

North America – A 1.1% decline driven by restrictive CAPEX spending, rising inflation & interest rates.

Continental Europe remains stagnant focusing more on sustainability & compliance related investments.

Growing Markets:

India- A growth of 61.8% contributing 7.5% to the overall revenue. A leading Pan-India private insurer has gone live with over 100 products across 8 business lines, spanning the entire business scope from underwriting to policy servicing, claims processing, and reinsurance. TCS BaNCS insurance platform has activated 5,000+ agents to expand market reach and scale up business volumes.

Growth in the UK market is expected to remain on the same path. AO World, the UK’s electricals retailer engaged TCS to transform the systems that underpin its finance and operations functions while JLR has partnered with TCS to implement SAP Service Parts Management.

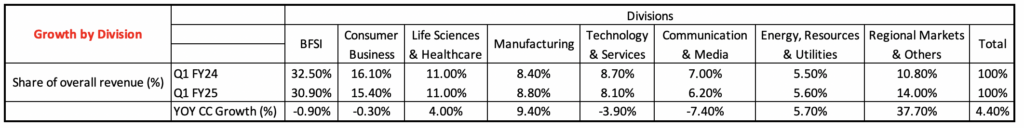

- Growth Breakdown by Divisons

BFSI– A 0.9% decline because of a fall in interest income of financial institutions led to reduced spending and shifted their focus on improving cost to income ratio.

Manufacturing- A 9.4% increase driven by cost optimization and operational efficiency strategies. Clients like JLR are responsible for the major proportion of revenue making significant investments in renewable battery manufacturing and inventory optimisation.

Life sciences & healthcare realised a growth of 4% due to increasing dependency on AI and IOT within these sectors. For instance, an increase in home and virtual consultation within healthcare.

Energy Resources & Utilities grew by 5.7% due to an increase in investments in sustainable practices.

Communication and media realised a decline of 7.4 as clients are focused on realizing the benefits from the investments in 5G made during the pandemic period before investing in any large-scale programs.

Technology and Services returned to sequential growth after 5 quarters. On a YoY basis, it declined 3.9%. Customers in this vertical remain cautious about new spending until business growth momentum picks up.

EBITDA: 26.61% for Q1 FY25

EBITDA appears to be stable as the margin ranged between 26%-28% over the last 4 quarters. In spite of the usual impact of the annual wage increments and third-party expenses, stable EBITDA validates the efforts towards operational efficiency.

Further takeaways:

– Clients are prioritizing initiatives that enhance the intelligence of their products and services, aiming to boost productivity, and operational efficiency and leverage next-gen technologies such as GenAI and IoT. Notably, the AI and GenAI pipeline has doubled in the quarter, reaching US$1.5 billion.

– Launch of TCS AI WisdomNextᵀᴹ, a platform aggregating multiple GenAI services into a single interface and enabling organizations to rapidly adopt next-gen technologies at scale, efficiently, and within regulatory frameworks.

– Some deals won in the quarter include a generative AI and cloud transformation deal with Xerox, a GenAI partnership with Amazon Web Services, and a BFSI deal with Burgan Bank.

– Net Headcount addition of 5452 after 4 quarters. LTM attrition has fallen to 12.1%. Due to lower YOY revenue growth compared to FY23 & FY22, it can be anticipated that management’s focus would be to increase the utility and productivity of the current workforce-focused training programs over hiring new employees.

– A Fall in TCV to $8.3bn from $10bn (QoQ) shifted emphasis to secure more short-term revenue programs within western markets.

Be First to Comment