- Revenue from Operations: Growth of 5.6% QoQ ($), 16.0% YoY ($), and 5.6% QoQ ($CC).

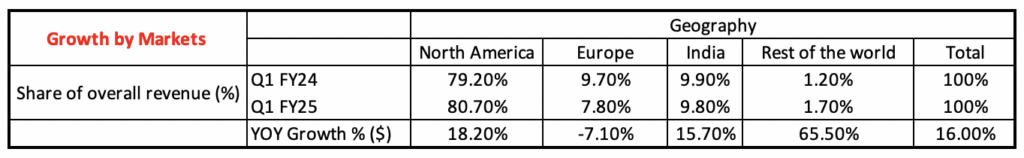

- Growth breakdown by Markets:

The European market has seen a downturn due to a decrease in Salesforce-related business. Management strategy is to rationalize the profitable clients with a related growth perspective.

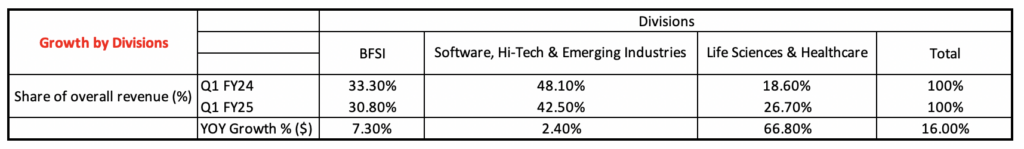

- Growth breakdown by Divisions:

The growth in the BFSI segment was primarily driven by delivering Generative AI and cloud solutions to an American Asset Management Company and other fintech firms based in the US.

The Software, Hi-Tech & Emerging Industries segment has sustained its growth by providing AI and SaaS-related services to improve operations and productivity within the network, IT, and semiconductor sectors. Management views the small growth as a temporary phase, given that the software industry is stable and future spending of the clients is anticipated to grow.

In the Healthcare & Life Sciences sector, growth has been primarily fuelled by rising software usage in healthcare operations and the deployment of AI to minimize manual errors. Alongside, the cloud-based platform that enhances analytics efficiency for a global health insurance client has resulted in a 1.67x increase in revenue for this segment year-over-year.

2. EBITDA has fallen from 18.2% in Q1 FY24 to 16.6% in Q1 FY25, marking the lowest level in the last 11 quarters.

Primary reason:

- Increase in employee cost by 25.78% YoY and 5.37% QoQ.

General wage hikes across the industry, equal or better compensation in terms of salary, stock options & other compensation as per the industry standards have driven the cost. Management anticipates that while the new employee program incurs significant upfront expenses and low marginal benefits initially, it shall eventually reverse respectively over the next few quarters.

Other reasons:

- 60 basis points increase in costs due to VISA cost (One time cost).

- 210 basis points increase in sub-contractor costs to support downside in key client accounts (Expected to replace sub-contractor with own employees in the future to have better control over the costs).

- 70 basis points increase in SG&A for which the benefits are to be perceived in subsequent quarters. No incremental spend on SG&A is expected in the future.

“We also invested ourselves very significantly in the last couple of quarters in terms of sales and marketing and now we think we have reached a stage where we have enough amount of investments done for the leadership part of it” – CFO statement.

3. Forward-looking takeaways:

– The blended employee utilization has improved to 82.1% in Q1 FY25 compared to 78.3% in Q1 FY24. Employee utilization & Operational efficiency have also improved by 90 basis points each. Management’s commitment to enhance it further shall improve the margins in the subsequent quarter.

– The fall in LTM attrition rate from 15.5% in Q1 of FY24 to 11.9% in Q1 of FY25 is now at par with the industry standards.

– Acquisition of Starfish, a platform that can manage multiple different contract service technologies in big corporates further strengthens the management commitment to capture big clients with a growth perspective.

– Healthy cash generation and growth on a YOY basis despite the major outflows of annual benefit payouts and renewal of enterprise applications.

– Headcount stands at 23,519 in Q1 FY25, a decrease of 331 QoQ and an increase of 389 YoY which might be the result of implementation of strategies like improving employee utilization and selective hiring.

– Total Contract Value (TCV) for Q1 FY25 stands at $462.8m, QoQ change by +15.1m. While the Annual Contract Value (ACV) for Q1 FY25 is $337.3m, QoQ changed by +20.5m.

Be First to Comment