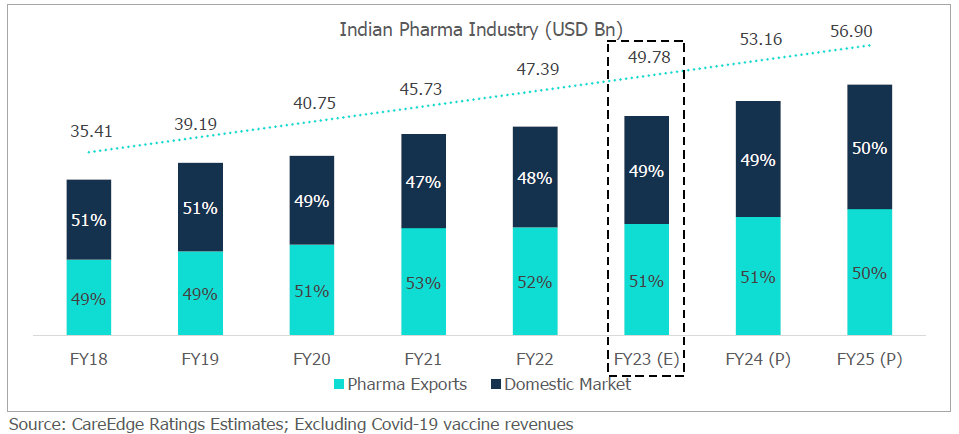

The Indian pharma industry has grown from USD 35.41 billion in FY18 to USD 49.78 billion in FY23 and is likely to reach USD 57 billion by FY25. Globally, Indian pharma industry has a strong footprint in the generics segment. The pharma exports and domestic market contribute equally to the overall Indian pharma Industry.

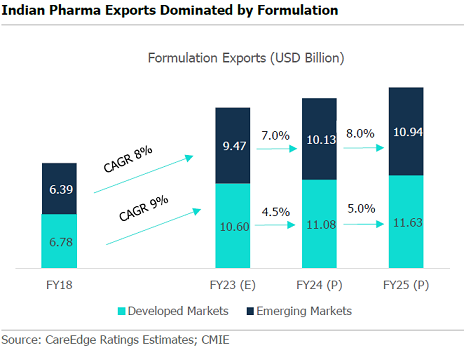

Pharma exports largely include formulation products which have grown at a CAGR of 8-9% during FY18-FY23. Regulatory headwinds and consequent lower ANDA approvals are likely to constrain the exports to developed market. However, increasing focus on synthesis segment, complex and speciality products apart from easing of pricing pressure in US generics are likely to support the growth in medium term. Increasing access to healthcare shall also drive the higher growth in emerging markets.

The US holds a prominent position as one of the largest export destinations for the Indian pharma industry, accounting for approximately 30-35% of total formulation exports. In recent years, the US generics market has experienced significant price corrections due to the consolidation of buyers and distributors. Despite these challenges, CareEdge Ratings has observed a notable increase in US export sales volumes, with expectations of sustained growth driven by upcoming patent cliff opportunities.

In FY23, formulation exports to the US recorded a growth of 5.9%, primarily supported by sales volume growth of around 16%. However, this growth was partially offset by a price erosion of around 10-11% (Source: CMIE). Furthermore, it is worth noting that the pricing erosion in the US generic market has eased to low single digit, a significant improvement compared to the high double-digit erosion witnessed in the past two years.

Looking ahead, there are substantial opportunities on the horizon, as approximately USD 188 billion worth of drugs worldwide are set to go off-patent during the period from CY2023 to CY2026. This presents a favourable landscape for the Indian pharma industry to capitalize on these patent expirations and expand its market share.

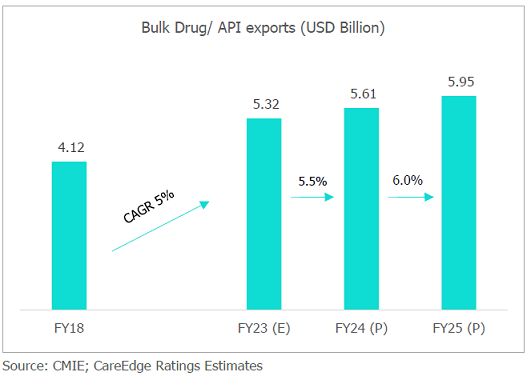

During FY23, the Indian Pharma exports stood at USD 25.39 billion which includes APIs/ bulk drug exports of USD 5.32 billion. After witnessing sharp rise in APIs/ bulk drug exports during FY21 due to COVID-19 led supply chain disruption in China, the exports of APIs/ bulk drugs have remained subdued during FY22 and FY23. The export of Bulk drug/ APIs is likely to grow at around 5-6% over FY24-FY25; in-line with its historical average.

Operating Margin to Reach to Pre-Covid Levels

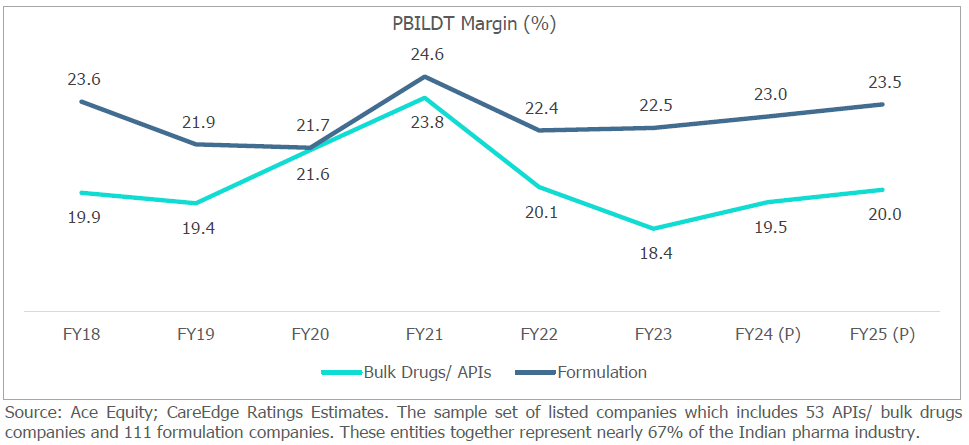

During the pre and post-Covid periods, the Indian pharmaceutical industry experienced significant changes in its operating profitability (PBILDT) margin. In FY21, due to the COVID-19 pandemic restrictions, there was a noticeable reduction in marketing, travelling, and conveyance expenses. Coupled with increased sales opportunities related to Covid-19, this resulted in a substantial increase in operating margins for the industry.

However, the subsequent years, FY22 and FY23, presented new challenges for the pharma sector. Elevated input prices, rising freight costs, extended delivery timelines, and competitive pressures in the US generics market led to a moderation in operating margins.

As we look ahead, there are positive signs for the industry. Raw material prices are stabilizing, freight rates are normalising, and pricing pressure in the US generics market is easing. These factors are expected to contribute to an expansion of operating margins by approximately 100 to 150 basis points over FY24-FY25 compared to FY23. Furthermore, the industry’s continued focus on launching specialty and niche products in the US market is anticipated to provide further support to the profitability.

CareEdge Ratings’ View

“The Indian pharma sector is expected to grow at a steady pace in the medium term due to structural factors such as ageing of the population, rising lifestyle or chronic diseases, healthcare awareness and insurance penetration apart from increasing government spending under various schemes. Further, changing world demography along with complex and specialty generic products are expected to drive the export growth of Indian pharma companies. The export growth would also be supported by patent expiry in regulated markets. Going forward, CareEdge Ratings expect higher export growth rates for emerging markets compared to growth rates of developed markets. The Indian pharma industry is expected to see a growth of around 7% to 8% over FY24-FY25 while the operating profitability of formulation companies to improve to around 23-23.5% and that of APIs/ bulk drug companies to improve to around 19-20% during the same period”, said Krunal Modi, Associate Director at CareEdge Ratings.

Be First to Comment